A few weeks ago, the open data community received a bit of a shock, in the form of a sharp, well-argued critique by Evgeny Mozorov. He claims that the “open government” meme hides a disconnect between those of us who interpret openness as transparency, accountability and ultimately human rights; and those that interpret it as contendibility to market competition, efficiency and GDP generation. In the extreme, he argues, “open government” can be made to mean “government open to competition from the private sector for the management of public goods”.

I agree with Mozorov that the difference in approach is there. However, I propose a point of view to reconcile the two different outlooks in practice. To do this, I borrow the words of the Italian blogger Michele Vianello, whom Mozorov would place firmly in the “openness for growth” camp. Michele is unconvinced by the sort of data that the Italian open data movement advocates the opening of.

How can we not understand that the most important data to open are those that enable citizens, businesses and government to generate economic and social value? […] How many GDP percentage points do we gain by live streaming the meetings of the parliamentary commissions?

Michele’s idea seems similar to what Mozorov attributes to the O’Reilly camp:

- The purpose of open data is mainly to stimulate economic growth.

- We can do so by releasing data that are amenable to being used for building value added services rather than government transparency data.

1 is the point debated by Mozorov. It comes down to what your values are. Let me leave it at that for now – I’ll come to it in a moment.

2 is definitely false – in the scientific sense of being contradicted by a veritable tide of economic literature. In the case of Italy, Corte dei Conti, our top administrative tribunal, estimates that corruption costs 60 billion euro a year. A few years ago this paper was quite popular (and there are many others). It says: increasing corruption by 1% (measured by polling indicators: corruption is by definition elusive to measure “at the tap”) implies a decrease of the GDP’s growth rate by a bit more than half a percentage point. Over the years, obviously, foregone growth itself follows an exponential growth curve – compound interest is an ugly beast – so that even small differences in the levels of corruption can lead to large ones in the absolute levels of national wealth.

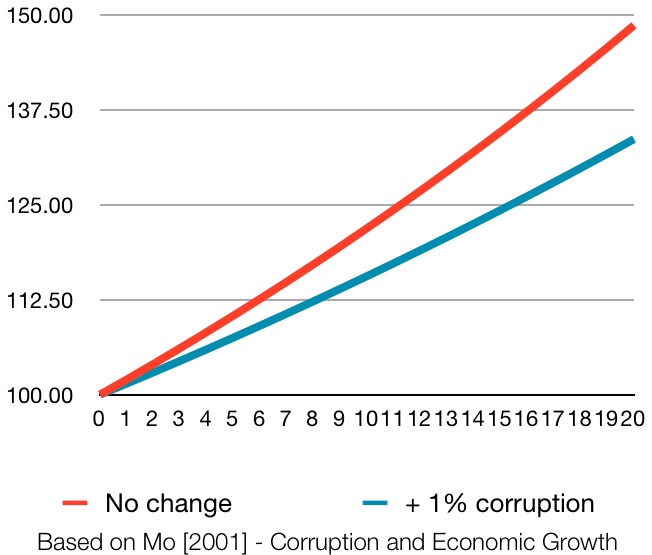

In the following chart I imagine two initially identical economies (GDP at time 0 = 100), which would each grow by 2% a year in the absence of changes in their levels of corruption. I then posit that one of the two experiences a 1% increase in the levels of corruption in year 1. Following Mo, 2001 quoted above, this decreases its rate of growth by 0.54 percentage points. Corruption levels and everything else remain stable thereafter.

Twenty years later, the GDP of the more virtuous economy has a fifteen percentage points lead on the less virtuous one. Not by chance, the World Bank, OECD, UNDP and every other development agency worth its salt is turning an increasingly interested eye to pro-transparency, anti-corruption policies. Nor is it just corruption: the combination of open data, a lively data journalism scene and an attentive public opinion can help improve the effectiveness of public spending executed legally but poorly, that follows the same mathematical logic in decreasing growth. This is the rationale behind projects like Opencoesione (public expenditure data on over 600,000 projects funded with regional cohesion funds). Remember Linus’s Law: given enough eyeballs, all bugs are shallow.

Now, open data are not only a component of transparency; my experience (and, I think I can say, the Italian community’s – just look at Spaghetti Open Data) is that they generate additional demand for transparency, drive to better understand, order in the data generation and in the policy process.

Conclusion: we, the open government/open data community, can disagree about our value system. But in practical terms, value systems does not make a lot of difference: we should all support radical transparency policies. If you agree with Mozorov, you will do it because you think we all have a right to know in depth what the government (and, hopefully in the near future, corporates) is doing, since that impacts our lives. If you agree with Vianello, you’ll do it because it’s good for GDP. Either way, the economic impact of open data has a tried and true channel for economic impact via increased efficiency in the overall economy from transparency; it’s there and it is solid. At the time of writing, it looks far more solid than impact via jobs created by startups that sell apps on Apple’s AppStore or Google’s Play.